The Plot Twist Nobody Saw Coming

Remember 1998? Probably not—you were either in diapers or obsessing over Tamagotchis. But if you had tossed $1,000 at the NASDAQ 100 back then, you'd have walked away with $5,000 just two years later. That's the kind of return that usually takes a decade, not 24 months.

Here's the thing: We might be standing at the edge of another historic breakout. But plot twist—this time it's probably not coming from the NASDAQ 100. The setup is different, but the potential rewards? Just as bonkers.

Same Movie, Different Cast

Back in the late '90s, oil prices completely face-planted (down 60% from 1997 to 1999). This pushed inflation lower and gave the Fed room to cut rates. Translation: investors got greedy and piled into tech stocks like they were going out of style.

Sound familiar?

Oil is down nearly 50% from its 2022 peak. Inflation is chilling out. The Fed already started cutting rates in 2024 and might keep the party going into 2025. We're basically watching the same movie with a different cast:

Energy prices: ✅ Falling

Inflation: ✅ Cooling

Fed: ✅ Being nice to markets

Risk appetite: ✅ Coming back

The stage is set for another speculative boom, folks.

History Doesn't Repeat, But It Sure Does Rhyme

In 1998, markets had a proper meltdown thanks to the Asian Financial Crisis and LTCM blowing up. But then? They bounced back harder than a rubber ball on concrete.

Fast forward to 2025: Markets stumbled on trade war fears and economic doom-scrolling. But instead of a recession, the economy kept trucking along. The result? Another sharp rebound that's giving serious '98 vibes.

Right after that '98 recovery, tech stocks went absolutely vertical. We might be at the same tipping point right now.

SOC 2 in 19 Days using AI Agents

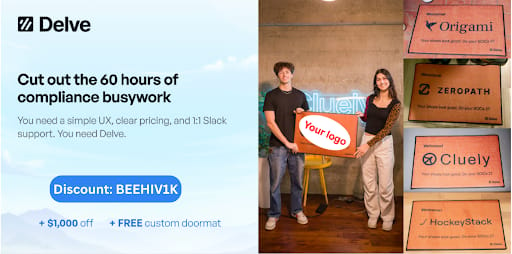

We’re Delve — the team that went viral for sending custom doormats to over 100 fast-growing startups.

That stunt? It cost us just $6K and generated over $500K in pipeline. Not bad for a doormat.

But if you haven’t heard of us yet, here’s what we actually do: Delve helps the fastest-growing AI companies automate their compliance — think SOC 2, HIPAA, ISO 27001, and more — in just 15 hours, not months.

Our AI agents collect evidence, generate policies, and prep everything while you keep building. And when it’s time to close your enterprise deal? Our security experts hop on the sales call with you.

We’ve helped companies like Lovable, Bland, Wispr, and Flow get compliant and grow faster — and we’d love to help you, too.

Then: Internet Goes Brrr | Now: AI Goes Brrr

Back in the day, the internet was the shiny new toy. Money flooded into tech stocks because everyone (correctly) thought the internet would change everything.

Today? AI is playing the same game. And unlike some of the internet bubble madness, AI adoption is actually happening:

Early 2024: Only 4-5% of companies were using AI

Mid-2025: That number nearly doubled to 10%—and it's accelerating faster than a Tesla in ludicrous mode

Semiconductors (the picks and shovels of the AI gold rush) are leading the charge. Since ChatGPT dropped in 2022:

Semiconductor sector: Up 200%

S&P 500: Up 70%

And we're probably just getting warmed up.

The Numbers Don't Lie (Even When They're Insane)

Let's time-travel to the late '90s for a sec. From 1996 to 1999:

Tech stocks: 200% returns

Broader market: 80% returns

Then 1999 happened and things got spicy:

NASDAQ 100: Another 200%

S&P 500: 30%

Today's semiconductors are following a similar playbook:

Earnings are growing faster than late '90s tech

From mid-2023 to mid-2025: Sector earnings jumped from $100 to $230

That's a 50% annual growth rate (compared to tech's 20% back then)

Current semiconductor P/E ratio? 30—exactly where tech was in 1998 before it rocketed to 50 during the dot-com boom.

If earnings keep growing and investors keep getting excited, we could see:

Valuations rise from P/E 30 to P/E 40

Earnings grow another 50% in a year

Do the math: That's potentially an 80% gain in semiconductor stocks over the next 12 months.

The Bottom Line

This isn't just a "hey, this chart looks familiar" moment. We've got macro conditions, fundamental growth, and sentiment all pointing toward something that could rival the late '90s tech melt-up.

Will there be pullbacks? Absolutely. Markets love their drama. But we're preparing to ride the next wave when it hits.

Enjoyed this deep dive? Your shares help us reach more people who need to know what's happening in the markets. Forward this to that friend who's still trying to figure out what a semiconductor actually does.